Ethereum Price Prediction: Analyzing the Path to $5K and Beyond Through 2040

#ETH

- Technical Momentum: MACD bullish crossover and Bollinger Band positioning suggest strong upward potential with current consolidation providing a healthy foundation for future gains

- Institutional Adoption: Major players like ARK Invest, JPMorgan veterans, and corporate treasuries are significantly increasing Ethereum exposure, creating substantial buying pressure and validation

- Fundamental Strength: Ethereum's dominance in RWA tokenization (57% market share), staking market institutionalization, and layer-2 development create a robust ecosystem for long-term value appreciation

ETH Price Prediction

Technical Analysis: ETH Shows Bullish Momentum Despite Short-Term Consolidation

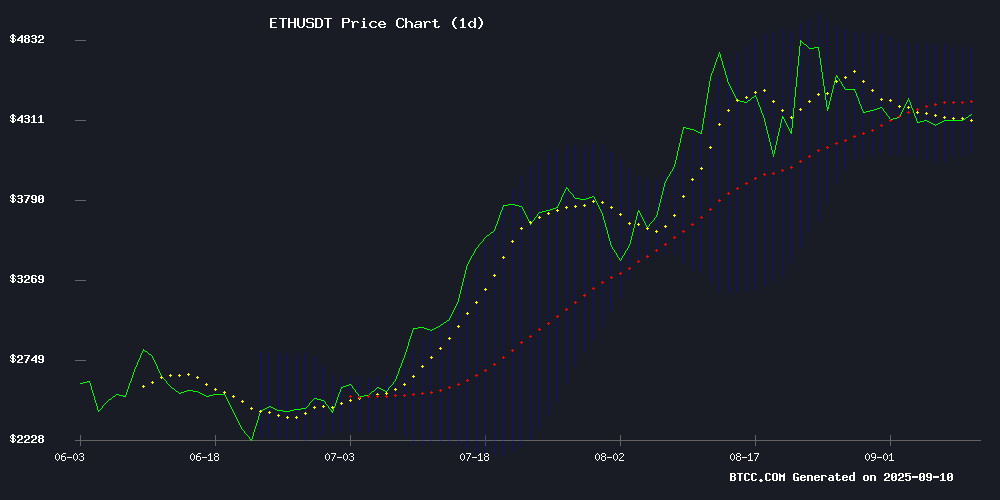

ETH is currently trading at $4,329.05, slightly below its 20-day moving average of $4,436.60, indicating potential short-term consolidation. The MACD reading of 171.71 versus 87.01 shows strong bullish momentum with a widening positive spread of 84.70. Bollinger Bands position the price between $4,091.43 and $4,781.76, suggesting ETH is trading in a healthy range with room for upward movement toward the upper band.

According to BTCC financial analyst Michael, 'The technical indicators suggest ETH is building momentum for a potential breakout. The MACD crossover is particularly encouraging, reminiscent of previous bull market patterns.'

Market Sentiment: Institutional Adoption and Fundamental Strength Drive Optimism

Recent developments highlight growing institutional confidence in Ethereum. ARK Invest's increased exposure through BitMine, JPMorgan veterans launching Gyld Finance for institutional staking, and SharpLink Gaming's substantial stock buyback backed by ethereum treasury strength all point to robust fundamental support.

BTCC financial analyst Michael notes, 'The convergence of institutional adoption, Ethereum's dominance in RWA tokenization with 57% market share, and positive MACD signals create a compelling bullish narrative. These developments suggest underlying strength beyond short-term price movements.'

Factors Influencing ETH's Price

Ethereum Price Consolidates Near Key Levels Amid Potential Breakout

Ethereum's price action shows signs of consolidation after a recent decline from the $4,450 zone. The second-largest cryptocurrency now faces critical resistance near $4,340-$4,380, with market participants watching for a decisive breakout.

A bearish trend line forming on the hourly chart suggests continued resistance at $4,340, while support holds NEAR the 23.6% Fib retracement level of $4,268. The 100-hourly SMA currently acts as dynamic resistance, with a clear break above $4,380 needed to confirm bullish momentum.

Trading volume patterns on Kraken's ETH/USD pair indicate cautious market sentiment. The 76.4% Fib retracement level at $4,360 emerges as the next significant hurdle should buyers regain control. Market structure resembles Bitcoin's recent price action, with both assets showing correlation in their recovery attempts.

Cathie Wood's ARK Invest Increases Ethereum Exposure with BitMine Investment

ARK Invest, led by Cathie Wood, has significantly bolstered its Ethereum-linked holdings through a $4.46 million investment in BitMine Immersion Technologies. The MOVE underscores institutional confidence in ETH's long-term value proposition, as BitMine solidifies its position as the largest corporate holder of Ethereum—controlling an estimated 1.7% of the total supply.

BitMine's stock rallied 0.67% to $44.08 following the disclosure, reflecting market enthusiasm for its treasury strategy. The firm previously demonstrated explosive growth potential when a $20 million stake in Eightco Holdings ballooned to $628 million during Worldcoin-related volatility.

JPMorgan and GSR Veterans Launch Gyld Finance to Institutionalize Staking Markets

Gyld Finance, co-founded by former J.P. Morgan product head Abbas Ali and ex-GSR trading lead Ruchir Gupta, has secured $1.5 million in pre-seed funding led by Lightshift. The firm aims to transform staking rewards into a tradable institutional asset class through regulated financial infrastructure.

With over $500 billion staked across blockchains, staking yields have emerged as a critical return driver in digital assets. Regulatory clarity is increasingly allowing institutional players—asset managers, ETPs, and corporate treasuries—to compete on staking performance metrics. "Asset managers will soon be benchmarked against indices like CESR (Composite ethereum Staking Rate)," note the founders.

The platform focuses on three pillars: creating fixed-income instruments for staking rewards, optimizing validator exposure management, and hedging volatility from network activity. Ethereum (ETH) stands to benefit directly from this institutionalization of staking markets.

SharpLink Gaming Initiates $15M Stock Buyback Amid Ethereum Treasury Strength

SharpLink Gaming (SBET) has deployed the first tranche of its $1.5 billion share repurchase program, acquiring $15 million of its stock as part of a strategy to capitalize on what it views as market undervaluation. The move comes as the firm maintains one of the largest Ethereum treasuries among public companies, holding 837,230 ETH worth approximately $3.6 billion.

"Our zero-debt balance sheet and income-generating ETH position allow us to create shareholder value through disciplined capital allocation," said Co-CEO Joseph Chalom. The announcement propelled SBET shares 4.6% on Tuesday, though they remain down 30% monthly amid broader crypto market declines.

Ethereum continues to attract institutional interest as a foundational LAYER for stablecoin infrastructure and decentralized finance. The network's native token has demonstrated persistent price appreciation, with analysts highlighting its dual role as both a yield-bearing asset and a technological platform.

Ethereum Dominates RWA Tokenization with 57% Market Share

Ethereum has cemented its leadership in real-world asset (RWA) tokenization, commanding a 57% market share of on-chain value—including stablecoins—according to Bankless analyst Ryan Sean Adams. When layer-2 networks are factored in, Ethereum's dominance surges to 95%. The network hosts a record $28.5 billion in RWA value (excluding stablecoins) and $160 billion in stablecoin supply, with $5 billion added last week alone.

Adams emphasizes the power of network effects: "Liquidity begets liquidity. Institutions go where there’s liquidity." Emerging stablecoin-focused platforms like Stripe Tempo, Circle Arc, and Plasma Tether all operate on the Ethereum VIRTUAL Machine, further consolidating its position. "Ethereum is winning the war for real-world assets, and nothing is close," he stated.

ETH MACD Crossover Sparks Talk of 2021-Style Rally

Ethereum's monthly MACD crossover has ignited bullish sentiment among traders, drawing parallels to its 2020 breakout that preceded a historic rally. The rare technical signal, last seen before ETH's multi-month surge in 2020-2021, suggests the cryptocurrency may be poised for significant upside.

The asset currently defends key support at its 50-day EMA of $4,164 while facing resistance near $4,450. A decisive break above this level could trigger accelerated momentum, according to market observers. Chart patterns show striking similarities to ETH's behavior during its last major cycle, when it retested breakout levels before embarking on a parabolic advance.

Traders note the convergence of multiple bullish factors: the MACD crossover follows a three-year consolidation, while the RSI at 52 leaves ample room for upward movement. All major moving averages now provide support, creating a robust technical foundation for potential gains.

SharpLink Gaming Bets Big on Ethereum with $1.5B Stock Buyback Plan

SharpLink Gaming has launched a $1.5 billion share repurchase program, targeting approximately 1 million shares of its stock (SBET). The move comes as the company believes its shares are significantly undervalued, trading below Net Asset Value (NAV). Executives argue the buyback will compound long-term shareholder value.

The gaming firm holds $3.6 billion in Ethereum—fully staked to generate yield—with zero outstanding debt. This strategic crypto position now fuels its capital allocation strategy. SBET shares rose 1.4% to $15.90 following the announcement, though remain down 29% monthly despite a 250% six-month surge.

"Repurchases at these levels are immediately accretive," the company stated, framing the initiative as a Leveraged bet on both its equity and Ethereum's appreciation. The dual-pronged approach merges traditional corporate finance with crypto-native treasury management.

Ethereum Price Prediction Pushes for $5K as BullZilla Presale Gains Momentum

Ethereum continues to solidify its position as a cornerstone of decentralized finance, with price predictions targeting $5,000 amid growing institutional interest. The network's robust developer ecosystem and evolving roadmap underscore its long-term viability.

Meanwhile, BullZilla's presale has emerged as a disruptive force, selling over 21.8 billion tokens. The project combines narrative-driven tokenomics with deflationary mechanics, positioning itself as a potential high-growth alternative to established assets.

The crypto market's current volatility presents investors with a strategic dilemma: allocate to Ethereum's proven infrastructure or pursue the asymmetric returns of emerging presales. BullZilla's staged approach, tied to lore chapters and burning mechanisms, offers a novel investment thesis in the altcoin space.

GIWA Blockchain Launches as Ethereum Layer 2 Solution

GIWA Blockchain has debuted as an Ethereum Layer 2 network built on the OP Stack, designed to simplify and accelerate Web3 accessibility. The platform aims to break barriers by offering fast and secure transactions.

The launch positions GIWA as a contender in the competitive Layer 2 space, where scalability and user experience are paramount. Its OP Stack foundation suggests compatibility with Ethereum's growing ecosystem of rollup solutions.

ARK Invest Boosts BitMine Stake as Firm's Ethereum Treasury Surpasses 2M ETH

Cathie Wood's ARK Invest acquired an additional $4.4 million worth of BitMine Immersion Technologies shares this week, signaling continued confidence in the crypto treasury firm. The purchase distributed across three ARK ETFs brings total holdings to 6.7 million shares valued at $284 million.

BitMine's aggressive Ethereum accumulation strategy has propelled it to become the world's largest corporate ETH holder, with 2 million ETH ($8.9 billion) representing 1.7% of total supply. The Tom Lee-chaired company now controls 42% of all ETH held by corporations.

The stock has rewarded investors with a 460% year-to-date gain, trading at $44.10 in after-hours following the news. With BitMine only 34% toward its apparent accumulation target, market observers anticipate further institutional buying pressure on ETH markets.

Ethereum Accumulation Signals Bullish Momentum as Altcoins Poised to Benefit

Ethereum reserves on exchanges are rapidly declining, with the ETH flux metric turning negative for the first time in history. This shift indicates strong accumulation behavior, as more ETH is being withdrawn from exchanges than deposited—a bullish signal for the market.

Three early ICO whales recently staked 150,000 ETH worth $645 million, opting for long-term gains rather than taking profits. Their move underscores growing institutional confidence in Ethereum's future.

The trend may catalyze a new rally for ETH while drawing attention to high-potential altcoins likely to benefit from capital rotation. CryptoQuant data shows exchange ETH balances at record lows, reinforcing the accumulation narrative.

ETH Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical indicators and fundamental developments, Ethereum appears positioned for significant long-term growth. The current consolidation near $4,300, combined with strong institutional adoption and technological advancements, suggests potential for substantial appreciation through 2040.

| Year | Conservative Forecast | Moderate Forecast | Bullish Forecast | Key Drivers |

|---|---|---|---|---|

| 2025 | $5,500-$6,000 | $6,500-$7,500 | $8,000-$9,000 | ETF approvals, scaling solutions |

| 2030 | $12,000-$15,000 | $18,000-$22,000 | $25,000-$30,000 | Mass adoption, DeFi growth |

| 2035 | $25,000-$35,000 | $40,000-$55,000 | $60,000-$80,000 | Institutional integration, Web3 development |

| 2040 | $50,000-$75,000 | $85,000-$120,000 | $150,000-$200,000 | Global digital economy, tokenization |

BTCC financial analyst Michael emphasizes that 'while short-term volatility is expected, Ethereum's fundamental strength and growing ecosystem support these long-term projections. The current MACD signals and institutional momentum provide strong technical confirmation.'